A Decade of St. Louis Residential Real Estate Trends

Over the past decade, residential real estate has seen remarkable changes, influenced by economic shifts and societal trends. From the aftermath of the 2008 financial crisis to the impacts of COVID-19, the market has evolved significantly. In this post, we’ll explore the key trends shaping housing demand, supply, and market dynamics over the last ten years.

Residential Real Estate Timeline

- 2012-2015 was a slow climb back to a balanced housing market after the real estate bust of 2008.

- In 2017 we started seeing multiple offers and by 2019 they were common.

- In March 2020 the market shut down for three week due to the pandemic. Sales plummeted and everyone worried about recession.

- By May 2020 we were back to multiple offers.

- 2021-2022 we saw double digit year over year appreciation.

- The last half of 2023 we saw interest rates go from 3% to 6% in the span of 3 months. Another first.

- In 2023-2024 we have a legitimate housing shortage.

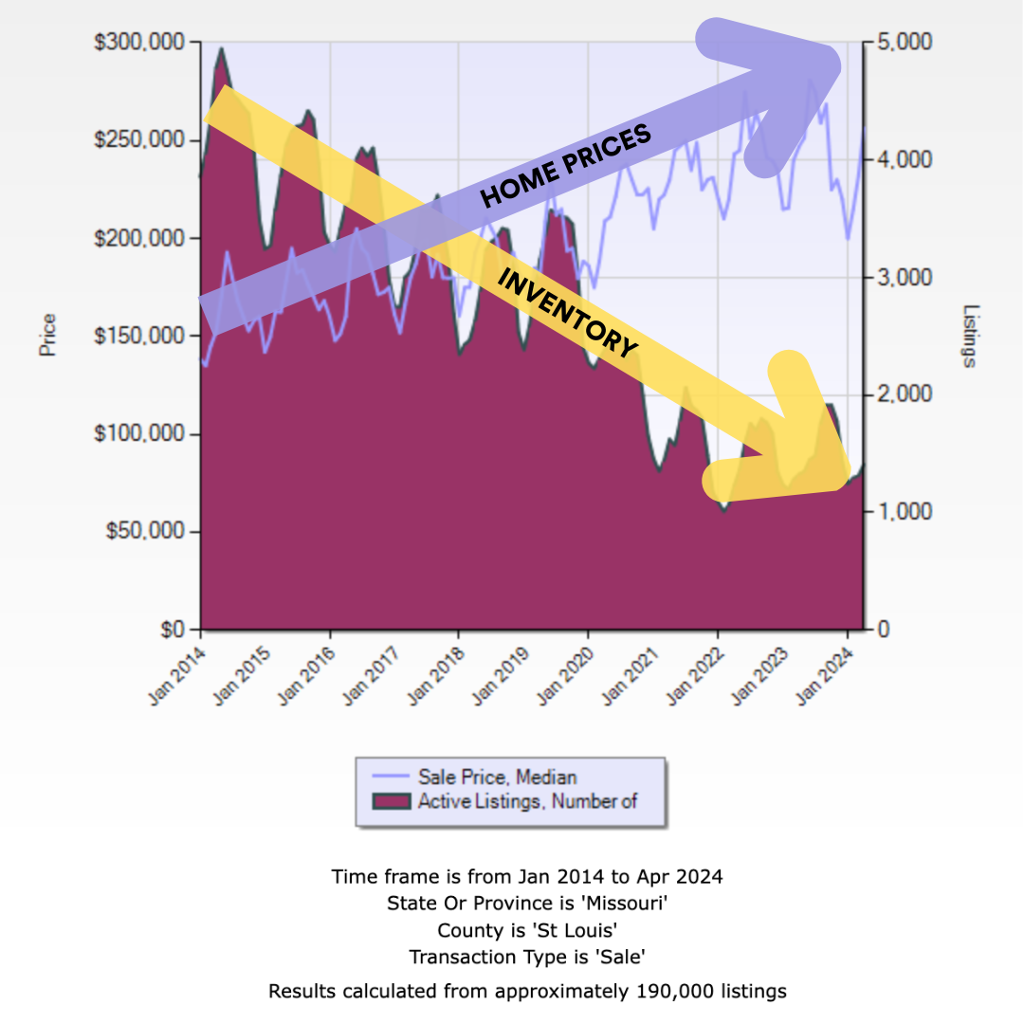

This timeline illustrates that there is no normal market! But what remains consistent is the concept of supply and demand. Low inventory continues to drive housing prices upward. The country needs around 1.6 million or higher for a few years to truly bring about a balance in the housing sector.

Historical Home Price (Entire MLS)

- Median Sale Price April 2024: $236,000

- Median Sale Price April 2023: $225,000

- Median Sale Price April 2019: $170,000

- Median Sale Price April 2014: $135,000

Housing Shortage & The Future

On a positive note, the 1.62 million housing unit completions in April 2024 was the second-highest monthly figure in 15 years. Expect apartment vacancy rates to trend higher, rents to slow down, and more homebuyers able to buy newly constructed homes. However, given the recent declines in housing starts, home completions will steadily show declines in about six months. The housing shortage is not going away. The laws of supply and demand tell us that home prices are on firm ground and could even reaccelerate in the future unless more is done to boost supply. Experts expect home prices to rise 4.8% year-over-year by the end of 2024.

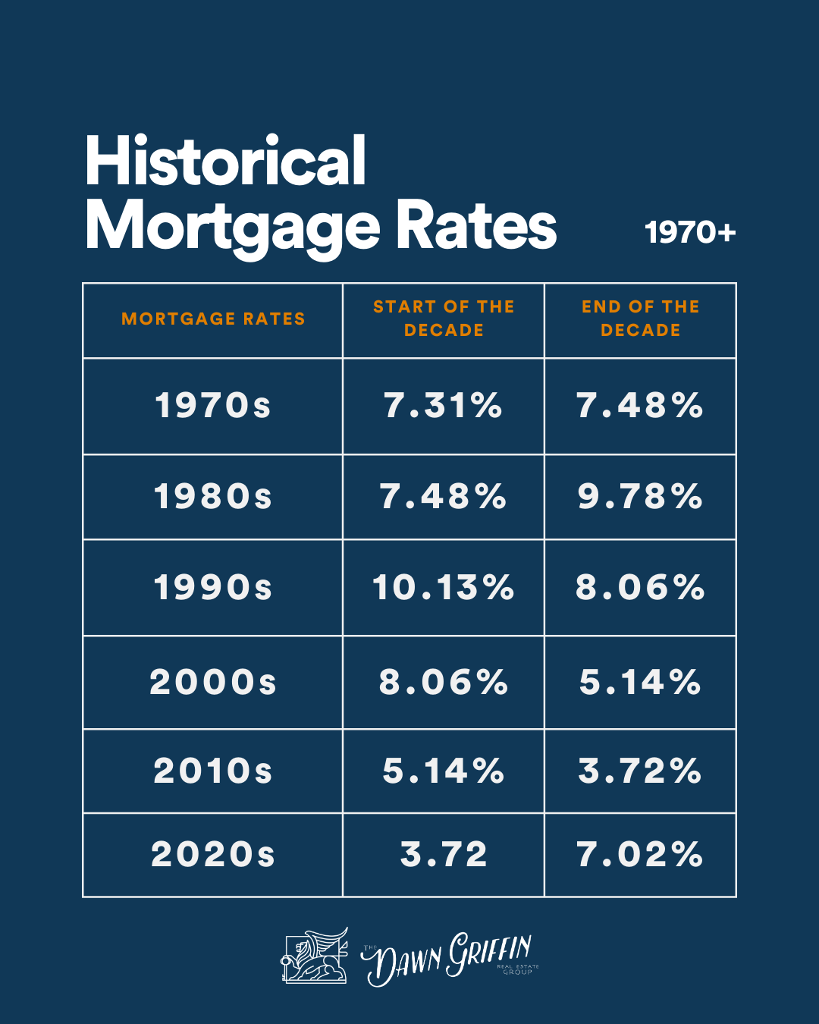

Mortgage Rates & Inventory

Rates roughly doubled back in 2022, thanks in part to the Federal Reserve’s war on inflation, and they have stayed high since. While the Fed does not directly set mortgage rates, mortgage lenders take cues from them, and mortgage rates climbed in tandem with the Fed’s long string of rate hikes.

More than 90% of current homeowners with mortgages have rates that are 6% or under, according to ICE Mortgage Technology, a mortgage data firm. While that is surely keeping some Boomers in their home, it is only part of the reason. Half of Boomers onw their homes outright and just aren’t downsizing. The median monthly cost of owning a home, which includes insurance and property taxes, among other costs, is just $612, according to the same report. So the expected results is not a flood of inventory, but a trickle, as Boomers do downsize to condos or somewhere new for retirement.

The Future

From market booms to downturns, navigating the complexities of property transactions demands expertise and foresight. A skilled realtor, well-versed in market fluctuations, not only interprets data but also anticipates shifts, ensuring optimal outcomes for buyers and sellers alike. Our ability to offer tailored guidance, leverage our network, and adapt strategies to evolving conditions underscores our indispensable value. In essence, partnering with a trusted realtor isn’t just advisable – it’s essential for success in the residential real estate market. We are always available to help. Contact us with any questions or to talk about a timeline for your real estate goals.