Cash Buyers Highest Since 2014

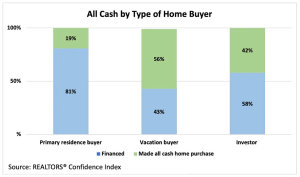

Mortgage rates are up, but so are cash buyers. Since October 2022, they’ve made up over 25% of home sales, reaching 32% by January 2024, the highest since June 2014. Who are these buyers? Recent data from the REALTORS® Confidence Index shows they’re often vacationers or investors. Yet, primary residence buyers are also using cash.

Primary residence cash purchases have surged in the last two years. These buyers typically sold their previous homes, using equity to purchase their next without a mortgage. In 2003, only 10% of repeat primary residence buyers paid all cash; by 2023, it was 26%. Among first-time buyers, 6% paid all cash in 2023, up from 4% in 2003.

One reason primary residence buyers can pay all cash is their tendency to move long distances. Cash buyers moved a median of 60 miles, with 29% moving 500 miles or more. In contrast, only 16% of financed buyers moved 500 miles or more, with a median distance of just 18 miles. While long-distance moves were more common during the COVID-19 pandemic’s onset, they continue, especially among retirees and remote workers.

As home prices are expected to rise in 2024 due to limited inventory and high demand, cash buyers are likely to remain prevalent. In January, the typical home received 2.7 offers, favoring cash buyers in bidding wars. Financing buyers may struggle to secure homes amidst competition, but it can be done. We are getting clients to the closing table every week.

In the Midwest, existing-home sales increased 2.2% from one month ago to an annual rate of 950,000 in January, down 3.1% from last year. The median price in the Midwest was $271,700, up 7.6% from January 2023.

It is more important than ever for homebuyers to work with realtors who have a solid grasp of the market and can help buyers prepare for this competitive landscape. Learn more on the January Housing Market here or reach out if you need help.