How the Federal Budget Bill Could Impact Residential Real Estate

This week the senate passed a sweeping budget bill that includes several real estate-related provisions. The bill preserves key tax incentives and adds short-term relief for certain taxpayers. But depending on your financial profile, the impact could look very different. As of Wednesday night, the bill faced an unexpected setback in the House, where a surprise Republican “no” vote added tension to the already closely watched debate.

To better understand how this bill might affect residential real estate, we turned to AI for help breaking it down—looking specifically at the financial implications for different types of buyers and what it could mean for our communities.

Here’s are the results:

Quick Recap: What’s in the Bill for Real Estate?

- Permanent mortgage interest deduction

- 1031 Like-Kind Exchanges protected

- Pass-through income deduction (Section 199A) made permanent

- SALT deduction cap raised from $10K to $40K (for households under $500K AGI, for 5 years)

- Bonus depreciation extended for real estate and business assets

- Child tax credits and business-friendly provisions extended

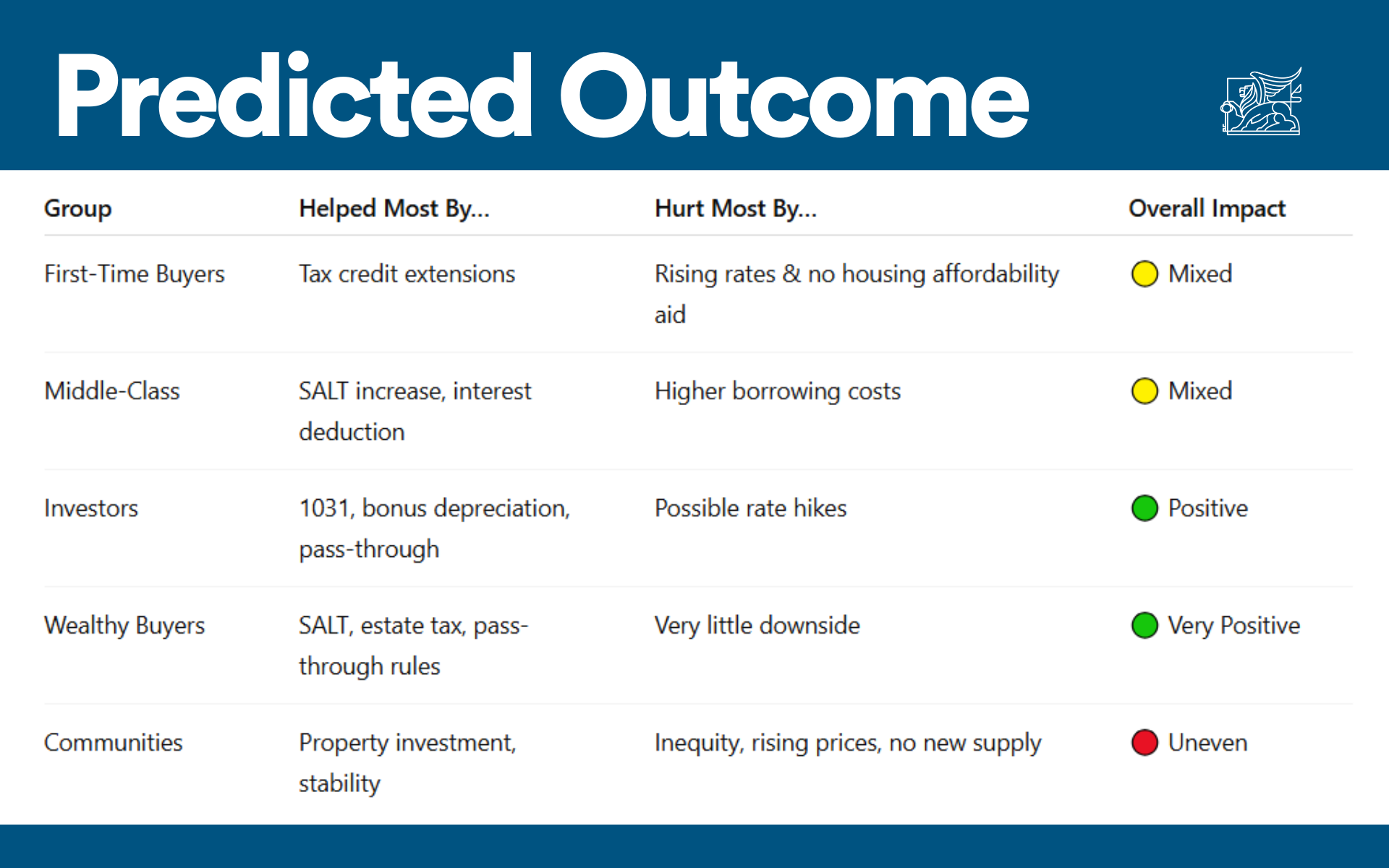

Financial Impact by Buyer Type

1. First-Time Buyers

Helped by:

- Child tax credit extensions may increase disposable income.

- If located in a high-tax area, SALT cap increase could improve affordability over time.

Hurt by:

- Inflationary effects: The bill adds trillions to the deficit, which could lead to higher interest rates. That directly impacts monthly mortgage affordability.

- No direct support for inventory growth, down payment assistance, or affordable housing, which are the top barriers for first-time buyers.

Bottom Line:

Small tax wins, but rising rates and stagnant inventory mean this bill offers little real relief in the near term.

2. Middle-Class Homeowners & Move-Up Buyers

Helped by:

- SALT deduction cap increase—especially if they live in a state with high property taxes.

- Mortgage interest deduction and pass-through income deductions for small business owners/1099 workers remain intact.

- Continued access to tax-advantaged homeownership tools helps maintain equity growth.

Hurt by:

- Potentially higher interest rates due to increased national debt.

- Home values may continue to rise due to limited inventory, which is a double-edged sword: good for current owners, harder for would-be buyers.

Bottom Line:

Modest financial benefits for current owners or established buyers, but rising housing costs and borrowing rates could offset any gain.

3. Real Estate Investors

Helped by:

- 1031 Exchanges are protected—investors can still defer capital gains tax.

- Bonus depreciation extended—investors can write off more property value upfront, boosting returns.

- Pass-through income deduction helps LLCs and S-Corps maximize profits.

Hurt by:

- No obvious downsides—this bill is largely investor-friendly.

- However, if borrowing costs rise and cap rates tighten, financing future acquisitions could get more expensive.

Bottom Line:

Big win. Investors retain all major tools in their financial playbook—and get short-term tax boosts too.

4. High-Income/Wealthy Buyers

Helped by:

- SALT cap expansion is a huge win in high-tax states (like NY, CA, NJ), especially for households with incomes just under $500K.

- Can still deduct mortgage interest, leverage pass-through deductions, and engage in 1031 exchanges.

- Estate tax and gift tax thresholds remain untouched—good for generational wealth planning.

Hurt by:

- If inflation climbs and market uncertainty rises, portfolio returns may be volatile.

Bottom Line:

Massive win. This bill preserves nearly every financial advantage for high-income real estate players.

Community-Level Impact of Budget Bill

Potential Benefits

- Preserving housing stability: Mortgage interest and SALT deductions can help households stay in their homes by reducing tax burdens.

- Investment incentives: Keeping 1031 exchanges and depreciation rules could encourage continued investment in rental and commercial properties—potentially boosting local economies.

Potential Risks

- Widening wealth gap: Most benefits flow to existing homeowners and high-income earners. First-time buyers, renters, and lower-income households get little relief.

- Reduced affordability: If this bill drives inflation or higher interest rates, it could increase home prices and mortgage costs—putting homeownership further out of reach for many.

- No direct supply-side solution: There’s no new funding for housing development or zoning reform, which are critical to solving the supply crisis.

Summary

The bill reinforces the benefits of homeownership and investment for those already well-positioned. But for first-time buyers and working-class families, it’s largely a missed opportunity. Without meaningful supply-side solutions or affordability initiatives, the dream of homeownership may slip even further out of reach—while investors and wealthy homeowners continue to build equity and minimize tax exposure.

Your Thoughts

Do you agree with AI’s assessment of the budget bill? Do you think any of these real estate provisions will impact you?