Property Tax Assessment Guide for St. Louis

In 2025, many homeowners in St. Louis City and St. Louis County are experiencing significant increases in their property tax assessments—some as high as 15% or more. These hikes are part of the biennial reassessment process mandated by Missouri law, which aims to align property values with current market conditions. While rising home values can be a sign of a thriving real estate market, they also lead to higher property taxes, which can strain household budgets.

If you believe your property has been overvalued, you have the right to appeal. Here’s a guide to understanding the reassessment process and how to navigate an appeal.

Why Are Assessments Increasing?

Property assessments are based on market value as of January 1 of the reassessment year. In recent years, the St. Louis housing market has seen substantial growth, with increased demand and limited inventory driving up home prices. Assessors use sales data from comparable properties to determine your home’s value, so even if you haven’t made improvements, your assessment may rise if nearby homes have sold for more.

Appealing Your Property Assessment

If you choose to appeal your property tax assessment, be aware that it typically requires an interior inspection of your home. While the goal is to lower your assessed value, there’s a chance it could increase instead.

Why could it go up?

If the assessor sees updates or features that weren’t previously accounted for—like a finished basement, renovated kitchen or bath, new windows, or a large addition—those improvements could actually raise your home’s value in their eyes. So understand the risk.

How to Appeal Your Property Assessment

St. Louis City

1. Informal Review (May 1 – June 23):

- Contact the Assessor’s Office by emailing appeal@stlouis-mo.gov or calling (314) 622-4185.

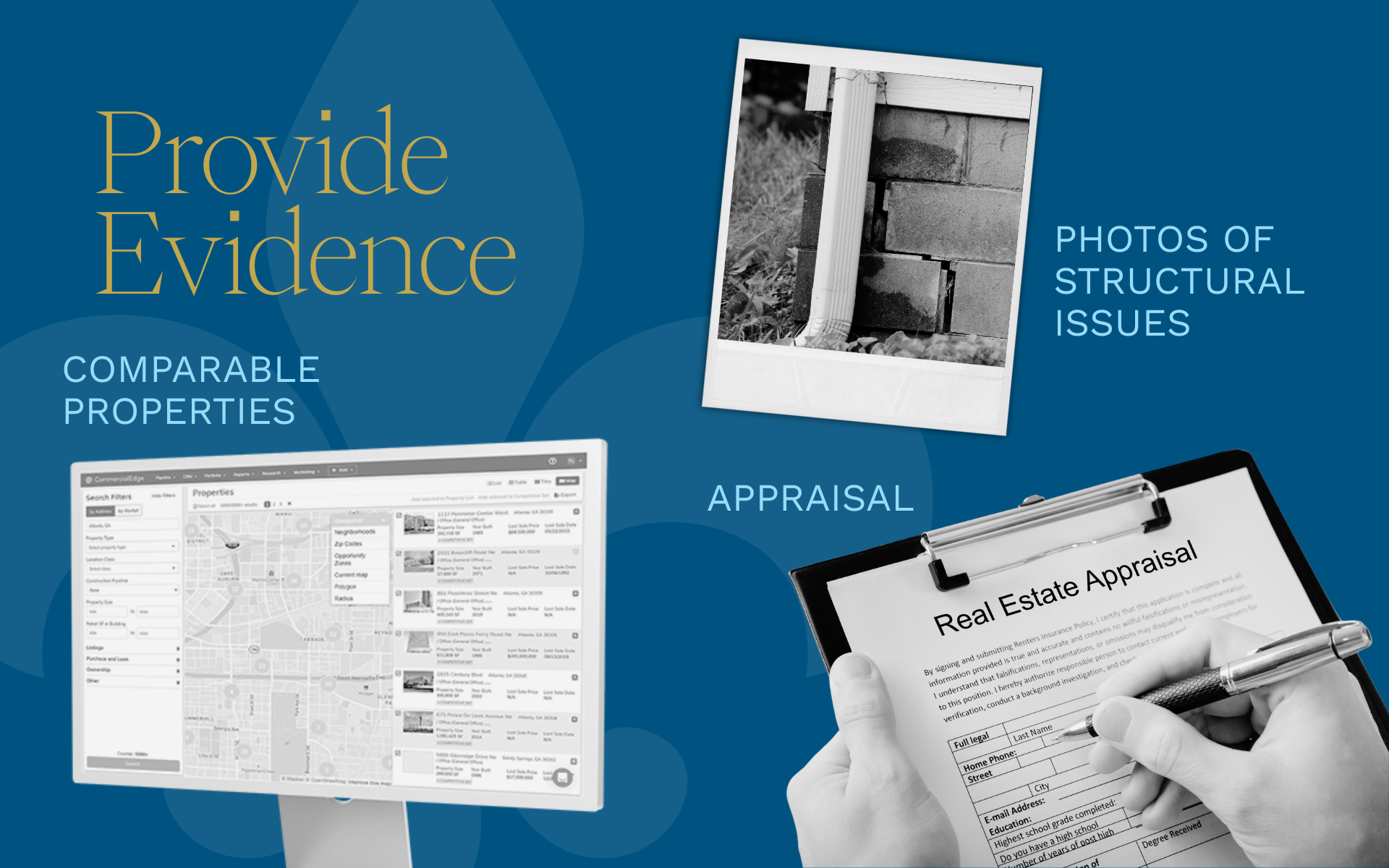

- Provide your property’s parcel number and any evidence supporting your claim, such as recent appraisals, sales of comparable properties, or photos of structural issues.

- An appraiser will review your submission and may adjust the assessment accordingly.

2. Board of Equalization (BOE):

- If unsatisfied with the informal review, you can appeal to the BOE.

- Request an appeal form by contacting the Assessor’s Office.

- Submit your appeal by the second Monday in July.

- The BOE will review evidence from both you and the Assessor’s Office and make a determination.

3. State Tax Commission (STC):

- If you disagree with the BOE’s decision, you may appeal to the STC by September 30 or within 30 days of the BOE’s decision, whichever is later.

- Residential property owners can represent themselves; commercial property owners must have legal representation.

St. Louis County

1. Informal Conference (Starting May 1):

- Schedule a meeting with a residential appraiser by calling (314) 615-4595.

- Meetings are held at two locations:

- Northwest Plaza: 715 Northwest Plaza Drive, St. Ann, MO 63074

- South Location: 9059 Watson Road, Crestwood, MO 63126

- Provide evidence such as recent appraisals or sales data to support your claim.StLouisRealEstateSearch.com

2. Board of Equalization (BOE):

- If the informal conference doesn’t resolve the issue, file an appeal with the BOE.

- Obtain the appeal form by calling (314) 615-7195 or visiting the BOE office.

- Submit your appeal by the statutory deadline, typically the second Monday in July.

- The BOE will schedule a hearing to review your case and make a decision.

3. State Tax Commission (STC):

- If you disagree with the BOE’s decision, you can appeal to the STC by September 30 or within 30 days of the BOE’s decision, whichever is later.

- File your appeal online through the STC’s website or by mail.

Tips for a Successful Appeal

- Review Your Property Record: Ensure that the Assessor’s Office has accurate information about your property’s size, condition, and features.

- Gather Evidence: Collect recent appraisals, sales data for comparable properties, and photographs highlighting any issues that may affect your property’s value.

- Understand Deadlines: Mark your calendar with key dates to ensure you don’t miss any appeal opportunities.

- Seek Professional Help: Consider hiring a real estate attorney or appraiser experienced in property tax appeals to strengthen your case.

Senior Property Tax Freeze Programs

On May 17, 2024, Missouri lawmakers expanded the Senior Property Tax Freeze program. Before, you had to qualify for Social Security benefits to be eligible. That rule is now gone, which means more seniors across Missouri may qualify.

There are still eligibility requirements, and you’ll need to apply in person. But if you qualify, this tax freeze can help keep your housing costs stable and ease the burden of rising property taxes as you age.

St. Louis City

The Senior Citizen Property Tax Freeze Credit program enables eligible seniors to freeze the city’s portion of their property taxes.

Eligibility Requirements:

- Age 62 or older.

- Own or have a legal/equitable interest in a primary residence within the city.

- The property’s appraised market value must be $514,500 or less.

- All prior year property taxes must be paid.

- The property must not be receiving tax abatement benefits.

Application Period: March 1 – June 30 annually.

Note: The freeze applies only to the city’s portion of the property tax bill and does not affect taxes levied by other entities such as public schools or the zoo-museum district.

How to Apply: Visit the City of St. Louis Assessor’s Office website for application instructions.

St. Louis County

The Senior Property Tax Freeze Program allows eligible seniors to freeze certain real estate property taxes.

Eligibility Requirements:

- Age 62 or older as of December 31 of the prior year.

- Own or have a legal/equitable interest in a residential property in St. Louis County as of December 31 of the prior year.

- The property must be the applicant’s primary residence.

- Only one primary residence can be claimed for the credit.

- Must be up-to-date on all real estate property taxes.

- Must apply annually to maintain the freeze.

Important Notes:

- The freeze does not reduce your total tax bill but prevents certain portions—primarily the County General Revenue tax—from increasing year to year.

- Other taxing districts (e.g., school districts, fire districts) may still raise rates, so your overall bill could still increase slightly.

How to Apply:

- You must file an application with the St. Louis County Department of Revenue – Revenue Division.

- Applications open in mid-May and are typically due by October 1 of the tax year.

- Documentation of age, residency, and ownership is required.

- More Info & Application: St. Louis County Senior Tax Freeze Info (check for updates annually as details may change).

More Info & Application: St. Louis County Senior Tax Freeze Info (check for updates annually as details may change).

Additional Resources

- St. Louis City Assessor’s Office: Appeal Your Property Assessment

- St. Louis County Assessor’s Office: How Do I Appeal My Property Value?

- Missouri State Tax Commission: File an Appeal

Final Thoughts

If your property assessment increased significantly this year, you’re not alone—and you do have options. Whether it’s filing an appeal or taking advantage of a senior tax freeze program, proactive steps can help you protect your investment and your wallet.

Don’t delay—deadlines come fast. Mark your calendar and start gathering documentation now.

Need help understanding your assessment or gathering comps? Our team is here to help—just reach out.