Economic Forecast 2025

Earlier this month, we attended one of our favorite St. Louis Realtors events of the year, the Economic Forecast Breakfast. The data presented gives us a broader perspective of the trends we see in our local market.

Charles Gascon, an economist and research officer from the Federal Reserve Bank of St. Louis, provided a robust outlook on the economy’s state and growth projections, specifically focusing on the labor market and inflation trends. Dr. Jessica Lautz, deputy chief economist and VP of research at the National Association of REALTORS®, shared insights on the latest real estate trends, demographic shifts, and the ongoing challenges in the housing market.

Summarized Economic Trends for St. Louis

Overall Economy

- The St. Louis economy remains stable with moderate growth, aligning with national trends.

- Real GDP growth has slowed but remains healthy.

- Consumer spending and personal income continue to rise.

- Inflation pressures have eased, though housing and service costs remain slightly elevated.

- Market rents indicate housing inflation may be slowing, but regional rent growth persists.

- Business contacts express cautious optimism, though concerns remain about high interest rates and economic slowdowns.

- Policymakers expect economic growth to moderate in 2025.

Labor Market

- Employment levels remain stable, with fewer job openings and declining job quits.

- Wage growth has slowed, particularly for job switchers.

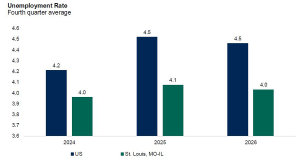

- Unemployment remains low but is gradually increasing, though in our region it is expected to stay below the U.S. average.

- Aging population and negative net migration limit labor force growth, contributing to low unemployment but slower regional output growth.

- Few reports of layoffs, but attrition rates have declined.

Economic Forecast & Risks

- Economic growth is slowing from elevated rates, with risks tilted to the downside.

- Business contacts expect little to no change in employment levels over the next 12 months.

- Wage growth is returning to normal but has not yet fully stabilized.

- Inflation pressures remain moderate, with near-term risks leaning toward the upside.

- Higher borrowing costs may impact consumer spending and business expansion.

- Anecdotal reports suggest a weaker economy than data indicates, though the outlook has been improving.

Real Estate Trends and Demographics

Market Overview

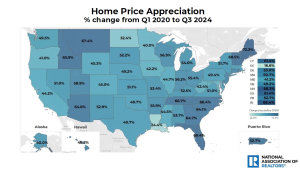

- St. Louis trend reflects national trend with high home prices but historically low sales volume.

- Home prices have appreciated significantly, with the median price nearing that of new construction homes.

- Inventory remains tight, with fewer existing homes available than in previous decades.

- The U.S. housing market needs about 5 million more homes to meet demand.

- Suburban and small-town living remain the most popular, but urban areas have hit a 10-year high in demand.

Affordability & Mortgage Rates

- 80% of mortgage holders have a rate below 4%, making many hesitant to sell.

- Mortgage rates are expected to remain in the mid-6% range for the remainder of the year.

- 15% of homes sell for over the asking price due to high demand and limited supply.

Higher mortgage rates have increased the qualifying income needed to purchase a home in the region to approximately $70,000.

Buyer & Demographic Trends

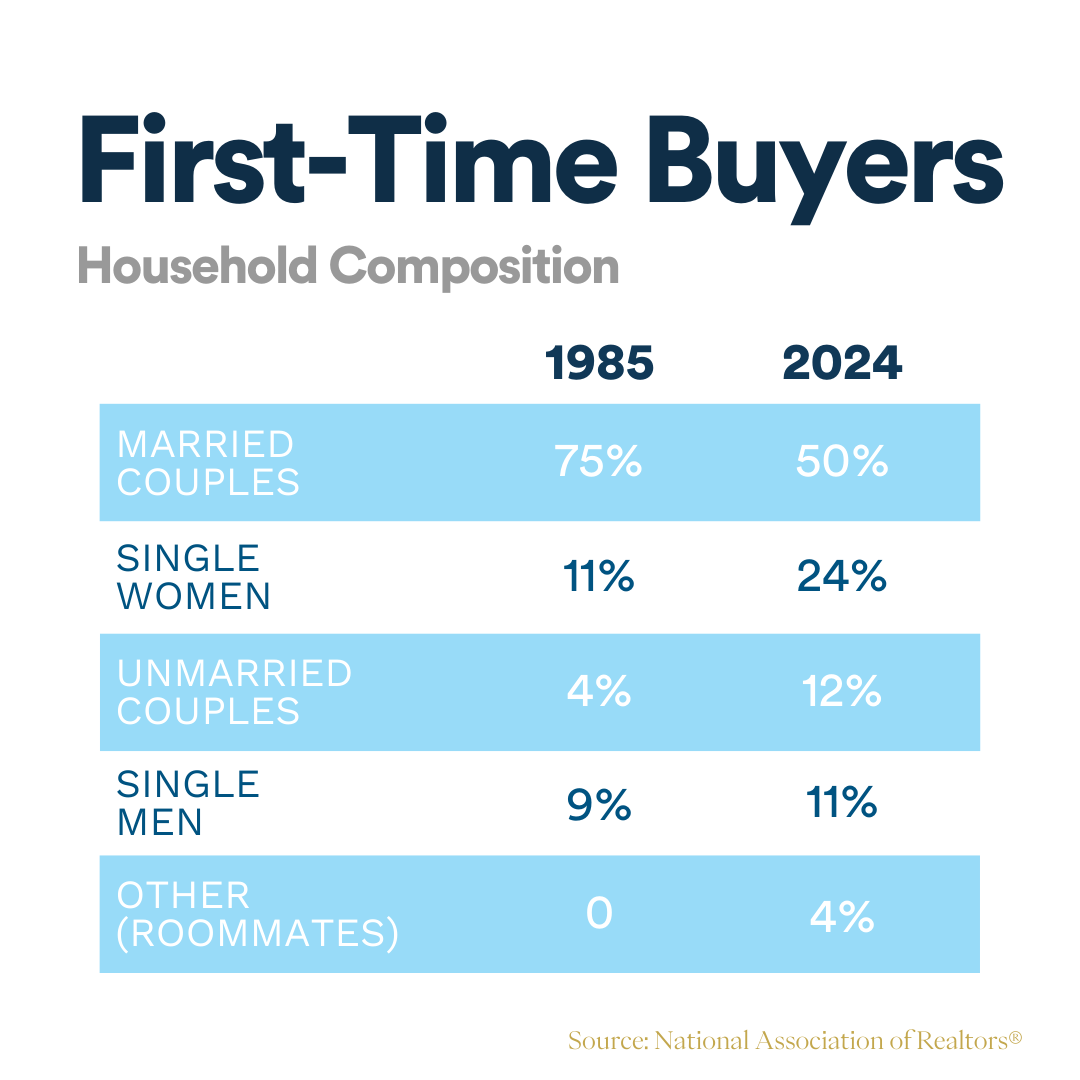

- The median first-time buyer age is now 38 years old compared to 28 years old 40 years ago.

- The typical repeat buyer age has increased to 61 years old.

- First-time homebuyers are at an all-time low, making up just 24% of the market.

- Multi-generational housing has hit an all-time high at 17%, reflecting affordability challenges and shifting living preferences.

- More buyers are making all-cash purchases, hitting 31% for repeat buyers and 9% for first-time buyers.

- Cash down payments are trending higher, reflecting rising home values and financial caution.

Rental & Investment Market

- The rental market remains strong, with regional rent growth continuing despite some national slowdowns.

Overall, the market is stabilizing but faces ongoing challenges with affordability, supply constraints, and shifting buyer demographics.

Economic Impact of a Typical Home Sale in Missouri

The real estate industry accounted for $73.8 billion or 17.1% of the gross state product in 2024.

Summary

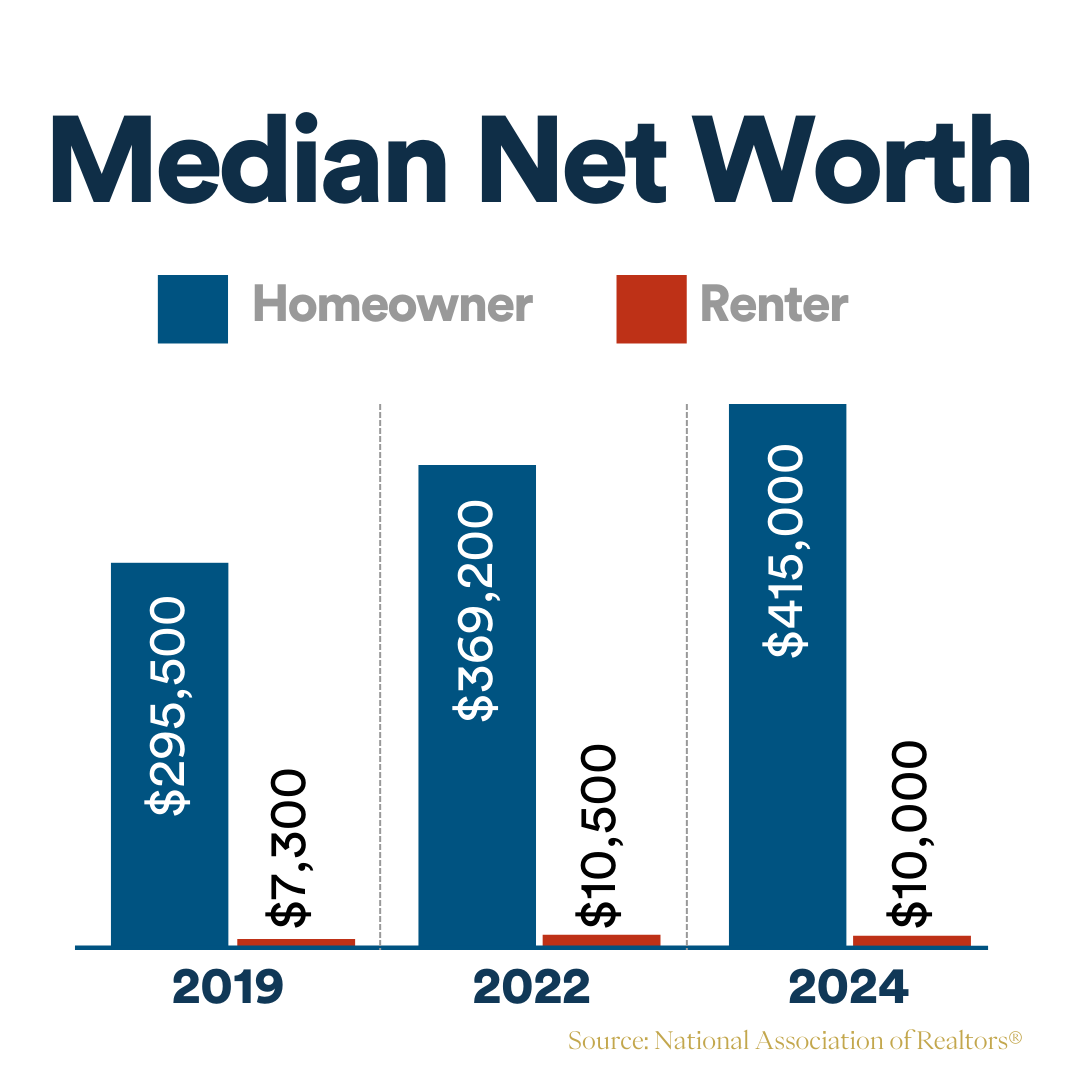

Homeownership continues to be a driver of wealth and desire of many Americans. But inventory and affordability are lingering issues. If you want help navigating the real estate market, we are here to answer your questions. Reach out anytime.