Understanding VA Loans

VA loans are a popular financing option for veterans and active-duty military personnel. Since the Congress authorized VA to guarantee mortgages in 1944, the program has backed more than 25 million loans, including more than 1.2 million mortgages with a combined loan balance of $375 billion in 2020. These loans offer numerous benefits to home buyers. However, it’s essential home sellers and buyers understand how they work.

About VA Loans

A VA loan is a mortgage loan program designed to help veterans, active-duty service members, and certain qualified members of the National Guard and Reserves achieve homeownership. It is guaranteed by the U.S. Department of Veterans Affairs (VA), which means that lenders are provided with a level of protection against potential borrower default. To qualify for a VA loan, individuals typically need to meet specific service requirements, such as a minimum period of active duty, honorable discharge, and specific service duty during wartime or peacetime. VA loans offer numerous benefits, including no down payment, competitive interest rates, and the absence of private mortgage insurance (PMI), making them an attractive financing option for eligible military personnel.

VA Loans For Home Buyers

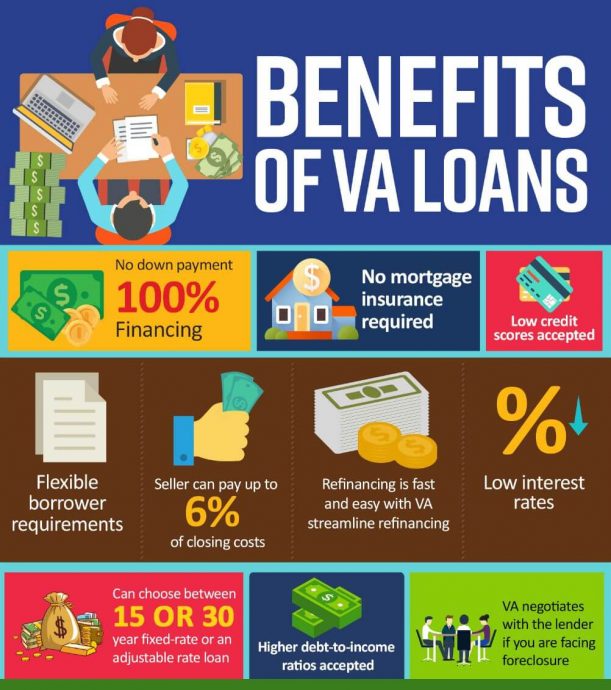

Benefits:

- No Down Payment: One of the most significant advantages of VA loans for home buyers is the absence of a down payment. This can make homeownership more accessible, especially for first-time buyers.

- Competitive Interest Rates: VA loans often feature competitive interest rates, which can result in lower monthly payments compared to other loan types.

- No Private Mortgage Insurance (PMI): VA loans do not require PMI, saving home buyers money each month.

- Flexible Credit Requirements: VA loans tend to be more forgiving of credit issues, making it easier for those with less-than-perfect credit to qualify.

- Streamlined Refinancing: VA loans offer the Interest Rate Reduction Refinance Loan (IRRRL) program, which simplifies the refinancing process, potentially lowering interest rates without a new appraisal.

Considerations:

- Funding Fee: Home buyers may be required to pay a funding fee, which can vary depending on your military status and the size of the down payment. This fee is typically rolled into the loan, but it’s an added upfront cost.

- Property Condition Standards: VA loans have strict property condition requirements, which may limit the selection of homes available for purchase.

- Occupancy Requirement: The home must be the buyer’s primary residence, limiting the use of VA loans for investment properties.

- Appraisal Challenges: VA appraisals can be more stringent, potentially leading to delays or the need for additional repairs before closing. The VA is primarily concerned about health and safety issues.

Loan Processing Differences for VA Loans

- The VA allows sellers to pay closing costs but doesn’t require them to. So the buyer might need money for closing costs. Borrowers may also need money for the earnest-money deposit.

- There are limits on loan amounts. The limits vary by county.

- VA loans are assumable, but if you let someone assume it then you can’t use that amount of VA loan eligibility on your next home.

- If you are purchasing new construction, the VA requires that the builder be a VA-approved builder.

VA Loan Information For Home Sellers

Benefits:

- Larger Buyer Pool: By accepting VA loans, sellers open their property to a larger pool of potential buyers, including veterans and active-duty military personnel.

- Favorable Terms: VA loans often come with competitive terms, making it more likely for buyers to secure financing and complete the sale.

Considerations:

- Strict Property Requirements: VA loans have strict property condition standards, which may require sellers to address issues that other loan types might overlook. Again, these are typically health and safety issues.

- Appraisal Challenges: VA appraisals can be more rigorous, which may lead to lower appraised values or repairs that sellers must address before closing.

- Longer Closing Times: The VA loan process can be slightly longer than traditional financing, potentially extending the time it takes to complete the sale.

Alternatives to VA Loans

For both home buyers and sellers, it’s important to be aware of alternative financing options and strategies.

For home buyers, alternatives to VA loans include conventional loans, FHA loans, and USDA loans. Each option has its own set of pros and cons, so it’s essential to evaluate which one best fits your financial situation and goals.

For home sellers, accepting offers from buyers with conventional loans or cash can provide quicker and potentially less complicated transactions.

Conclusion

VA loans offer significant benefits to eligible home buyers, but they also come with specific requirements and potential challenges. Sellers need to weigh the advantages of a larger buyer pool against the demands of VA loan requirements. Ultimately, understanding these pros and cons, along with exploring alternative financing options, can help both buyers and sellers make informed decisions in the real estate market. Working with a lender experienced with VA loans and their alternatives can help. If you need a recommendation of someone local, please reach out.