Two Questions Before You Consider a Home Purchase

Navigating the housing market can be overwhelming, especially when bombarded with information from various sources. To help you make sense of it all, let’s turn to the data. Two questions before you consider a home purchase should be around home prices and mortgage rates.

1. What is the future outlook for home prices?

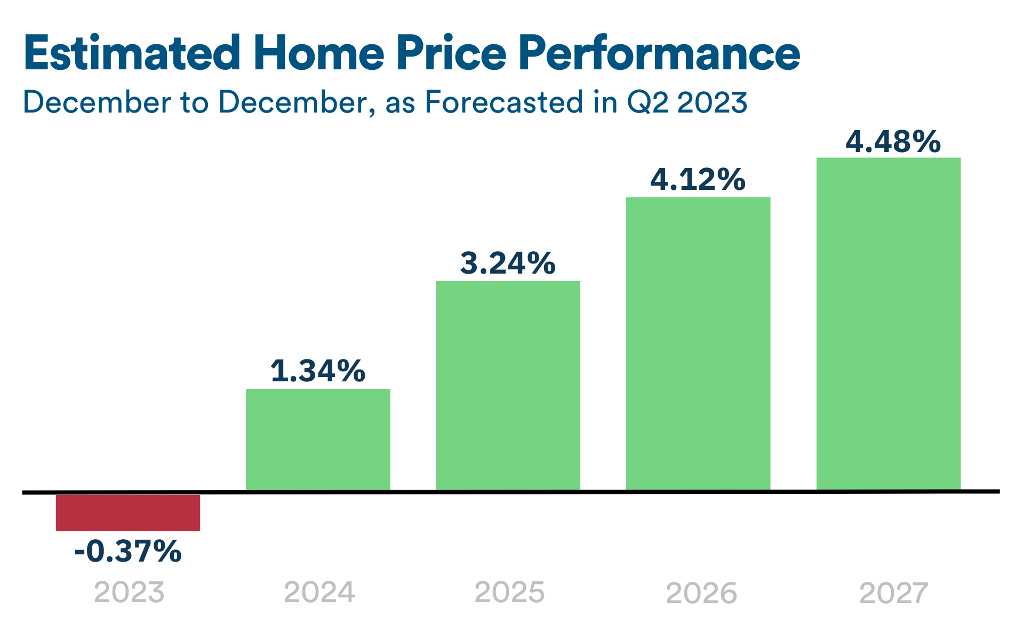

To gain reliable insights into home price trends, the Home Price Expectation Survey (HPES) conducted by Pulsenomics offers valuable information. This survey gathers the opinions of economists, real estate experts, and market strategists. The latest findings indicate a slight depreciation this year (shown in red on the graph). However, it’s important to note that the most significant declines have already occurred, and many markets are now experiencing appreciation. The projected 0.37% depreciation for 2023, as suggested by HPES, is far from the crash that some had initially anticipated.

Looking ahead, the graph displays green, indicating a turning point where home prices are expected to appreciate in 2024 and beyond.

This means that purchasing a home now has the potential for it to grow in value, allowing you to gain home equity in the coming years. Waiting may result in paying a higher price in the future, as suggested by these forecasts.

2. What is the likely direction of mortgage rates?

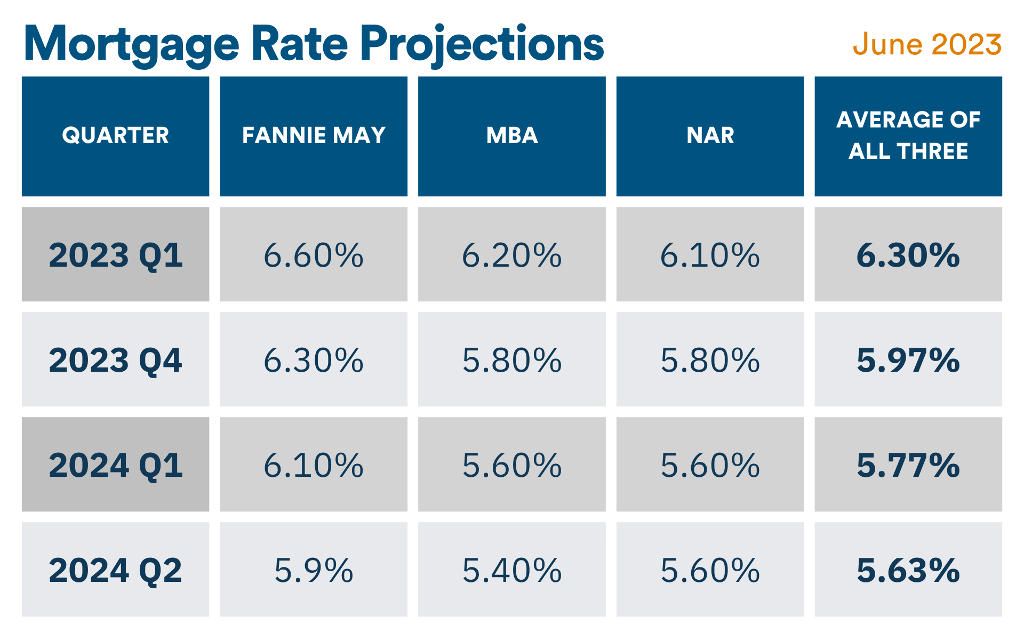

Over the past year, mortgage rates have risen due to economic uncertainty and inflationary pressures. Recent reports indicate a moderation in inflation from its peak, which is an encouraging sign for both the market and mortgage rates. Typically, when inflation eases, mortgage rates tend to decline. This suggests that mortgage rates may experience a slight pullback over the next few quarters, potentially settling around an average range of 5.5% to 6%.

However, it’s important to note that experts cannot predict with absolute certainty where mortgage rates will be next year or even next month. Numerous factors influence their trajectory. Considering the various possible outcomes, here’s what you should consider:

If you buy now and mortgage rates remain unchanged: It would be a wise move as home prices are projected to appreciate over time, allowing you to beat rising prices.

If you buy now and mortgage rates decrease (as projected): This decision would still be advantageous because you would acquire the property before further home price appreciation. Additionally, if rates are lower in the future, you can explore refinancing options.

If you buy now and mortgage rates increase: In such a scenario, buying now would be a great decision since you would have secured the home before both the home price and mortgage rates escalate.

Summary

If you are going to consider a home purchase, it’s essential to understand the expectations regarding home prices and mortgage rates. While no one can predict the future with certainty, expert projections can provide valuable information to keep you informed. Seek guidance from a trusted real estate professional who can offer an expert opinion specific to your local market conditions. That’s us!