How Homeowners Can Take Advantage of the Inflation Reduction Act

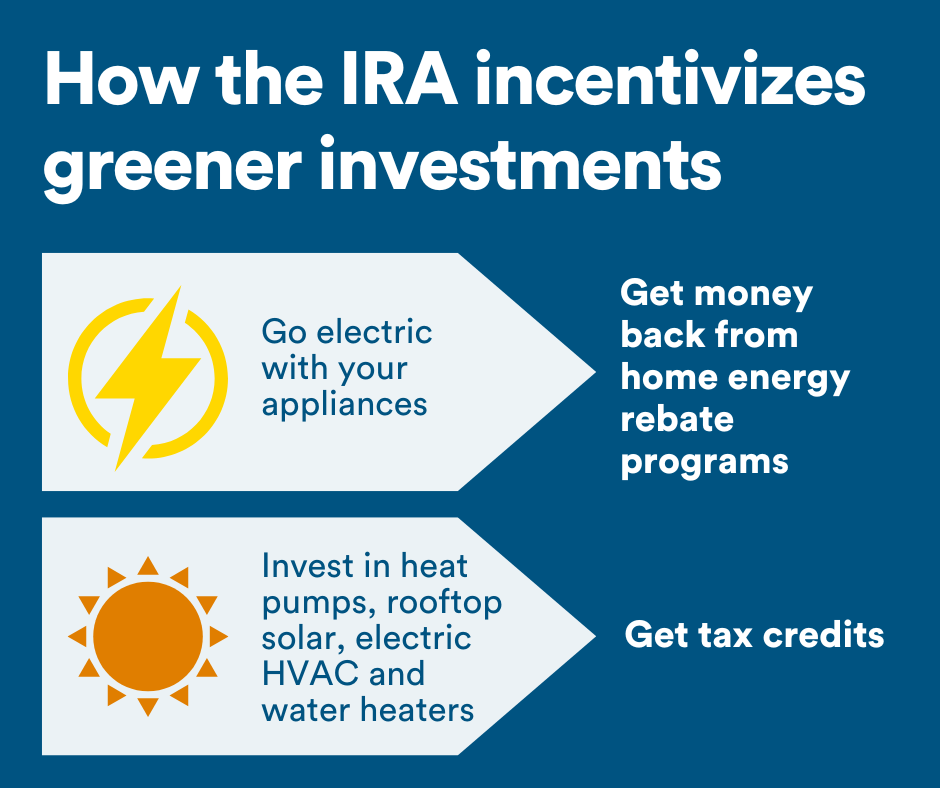

If you have been thinking about home improvements that will boost the energy efficiency of your home, you may save some money on your projects now that the Inflation Reduction Act (IRA) has been signed into law. It’s rare to see federal bills specifically target home renovations like these, so they are worth taking advantage of.

inflation reduction act rebates

The IRA offers rebates for new technology and for sealing and insulating a home. Within a certain income bracket, you can receive rebates like:

- Up to $1,750 for a heat pump water heater

- Up to $8,000 for a heating/cooling heat pump

- Up to $840 for an electric stove or cooktop

- Up to $840 for a heat pump clothes dryer

- Up to $4,000 for a new electric panel

- Up to $1,600 for upgraded insulation, air sealing, and ventilation

- Up to $2,500 for updated electrical wiring

A well-sealed and insulated home can save an average of 15% on heating and cooling costs.

For households earning below 80% of the area median income (AMI), rebate limits are substantial enough to cover the full cost of the project. The typical heat pump, for example, costs anywhere from $4,167 to $7,431 to install, while the maximum rebate allowance for a low-income household is $8,000. Those making 80–150% of the AMI would qualify for a 50% rebate on eligible electrical upgrades.

👉 TIP: Curious if you meet the income requirements for the new energy-efficiency rebates? Fannie Mae offers a free tool to help you find the median income in your area based on zip code.

energy efficient improvements tax credits

The IRA also creates tax credits for 30% of the cost of energy efficiency improvements including new windows ($600), doors ($500) and heat pumps ($2,000). Homeowners can claim up to $1,200 per year back on their taxes. Credits for efficiency decrease on the same schedule as solar.

The rebate program will be administered by the states, so the specifics of applying for and receiving rebates may vary, and the program isn’t yet in place.

The IRA is projected to reduce American carbon emissions by 42% by 2050.

Tax deductions for whole-house energy efficiency improvements

The Act will also create a second rebate program, which will pay households between $2,000 and $8,000 for undertaking holistic upgrades which significantly lower their energy waste, such as new insulation or air sealing. The rebate amount will depend on the achieved reduction in energy use.

Solar Tax Credit changes

The IRA also makes significant changes to a more familiar tax credit. Under the new rules, the federal solar tax credit for residential solar gets boosted from 26% to 30% and is locked in through 2031. It drops to 26% in 2033 and 22% in 2034. Before, the credit was at 26% and set to decrease to 22% in 2023 before disappearing altogether.

For a new solar array costing $20,000, homeowners can expect to deduct about $6,000 from their tax bill. As an added benefit, anyone who already took the plunge to install solar panels in 2022 can claim the full 30% credit retroactively during the next tax cycle.

Summary

These credits can provide valuable tax savings for those interested in installing green home improvements starting in 2023. With some planning, homeowners can now spread the cost of their energy-related home improvements over a few years to claim the maximum tax credits available each year.