2025 Real Estate Predictions vs. 2025 Reality

At the end of 2024, many analysts and housing-market watchers laid out forecasts for what 2025 might bring. As we near the end of 2025, here’s a look at what was predicted — and what’s actually happened so far.

2024 Predictions for 2025 vs. Reality of 2025

PREDICTION: Home-prices will continue rising — but growth will slow. Zillow’s late-Nov 2024 forecast predicted modest home-value growth for 2025.

REALITY: Where things stand as of November 2025: Prices are still rising — but much more slowly than in peak pandemic years. The national growth rate has decelerated significantly.

PREDICTION: No crash — the market will “normalize.” Many economists argued that despite high prices, a 2008-style crash was unlikely.

REALITY: Where things stand as of November 2025: That remains true: the consensus among experts is that a crash remains unlikely and what we’re seeing is “correction” or “normalization,” not collapse.

PREDICTION: Home-sales activity will stay low as rates stay high — but some rebound expected if rates ease.

REALITY: As of late 2025, the rebound is cautiously materializing: pending sales and existing-home sales have ticked up, especially in the Midwest and South.

PREDICTION: Inventory would gradually improve — meaning more choices for buyers. Forecasts assumed some easing in supply constraints.

REALITY: There are early signs of improvement: more listings are coming on the market, and in many metros prices are no longer spiking — giving buyers slightly more leverage.

PREDICTION: Many homeowners would stay put, reluctant to trade up because of rising rates. This anchored expectations of low turnover.

REALITY: That’s holding up: turnover remains historically low in 2025, with fewer homeowners moving and many holding onto ultra-low mortgages.

PREDICTION: Buyer mix would shift: fewer first-time buyers, more cash-buyers or buyers with large down payments. Some predicted tighter affordability would squeeze younger or entry-level buyers.

REALITY: That’s become reality. According to the latest from National Association of REALTORS® (NAR), first-time buyers are now a smaller share of the market, while all-cash offers and larger down payments are more common.

PREDICTION: Rents will rise, especially if homebuying remains out of reach for many. Some forecasts expected continued pressure in the rental market.

REALITY: Rents have indeed stayed elevated or risen further in many areas — partly because mortgage rates have kept many would-be buyers renting longer.

PREDICTION: A “buyer’s window” could open by late 2025, with more affordability and flexibility for buyers. Analysts said patient buyers might benefit if rates ease and inventory climbs.

REALITY: There are tentative signs: modest price gains, improving inventory, and slightly easier buying conditions — though “affordable” remains a stretch in many metros.

PREDICTION: Geographic shifts — growing interest in more affordable or mid-sized markets as buyers flee high-cost metros. Some expected demand to spread beyond traditional “hot” cities.

REALITY: That trend persists. Many smaller or more affordable metros are seeing steadier appreciation than the overheated big-city markets.

PREDICTION: Overall, a more balanced market by 2025 — fewer frenzied bidding wars, slower price increases, more realism.

REALITY: That is largely what we’re seeing: a “normal market” balance — slower price growth, more negotiations, and a mix of opportunities and challenges depending on region and buyer profile.

What “Hit,” What “Missed,” and What’s Mixed

Pretty Accurate Predictions

- The expectation that we wouldn’t see a crash — just normalization — seems right. Home-price growth is modest, not meteoric or plummeting.

- A slower pace of appreciation — rather than steep spikes — is how the market has behaved in 2025.

What Fell Short or Underdelivered

- Many buyers hoped for a strong sales rebound in 2025. That hasn’t happened at scale. Some forecasts underestimated the drag from higher mortgage rates.

- For some sellers, the hoped-for “pent-up demand boom” didn’t materialize — especially in markets with lingering affordability issues.

Mixed or Regional Results

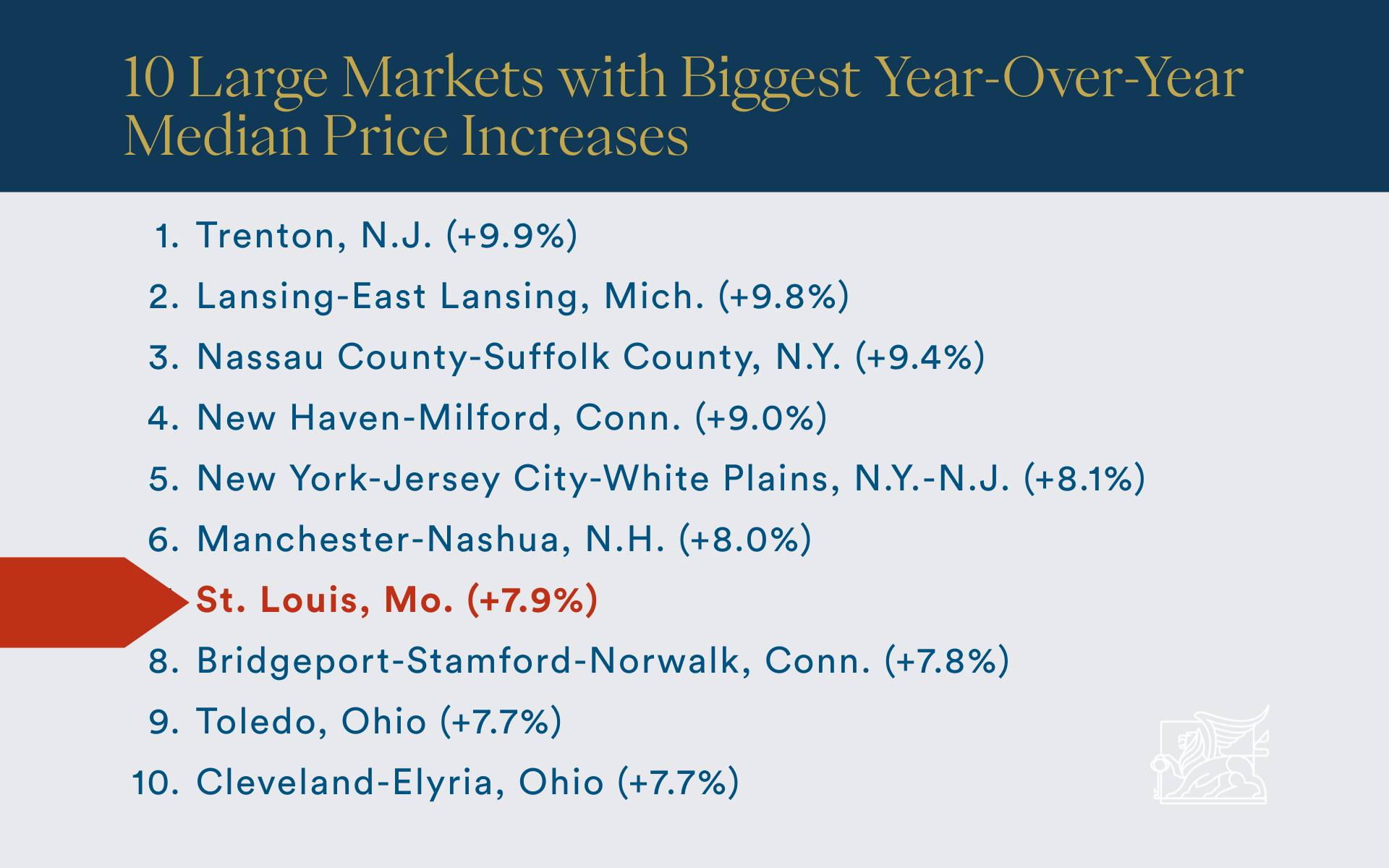

- While national averages suggest very slow price growth, other indexes (like the FHFA) show modest gains, hinting at regional variation. In other words: local markets — like our St. Louis area — may diverge meaningfully from the national average.

- Mortgage rates dropped from their pandemic-era lows, but not enough to restore pre-2020 affordability. So for many buyers, housing remains expensive.

What This Means — Especially for a City Like St. Louis

- If you’re a buyer, patience and selectivity may pay off. With slowed price growth and rising inventory, you might find more favorable terms than in the peak-pandemic years.

- If you’re a seller, it’s no longer a guarantee your home will fly off the market — pricing realistically and being ready to negotiate are more important than ever.

- For first-time or budget-conscious buyers, expect more competition from cash buyers and investors; affordability remains a big challenge.

- For investors or people who buy-and-hold, rent demand seems intact — and rental income may stay strong while home sale prices moderate.

- For agents — we’re back in a “balanced market” era. Our expertise, local knowledge, and relationships with peers and vendors are more important than ever.

Our Takeaway

2025 wasn’t a dramatic boom or bust — it’s been more like a recalibration. Many of the high-flying predictions of the pandemic era have cooled. Some of 2024’s modest expectations came true, others only partially. What remains constant: real estate is now more about strategy, realism, and patience than urgency.

St. Louis remains relatively affordable (compared with many major U.S. metros) and stable. That modest but steady appreciation can be appealing to both long-term homeowners and investors.

Whether we are working with buyers or sellers, honest conversations — about neighborhood comps, long-term equity, and realistic timelines — matter more than ever.