Buy A Home Now or Wait for the Recession: A Case Study in Ladue, MO

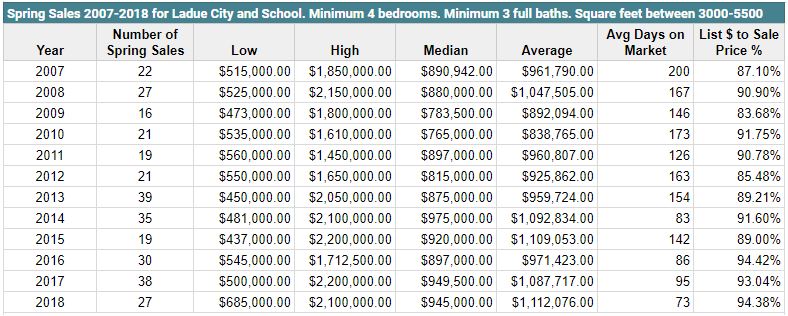

We have clients relocating to St. Louis from out of state and they are wondering if they should buy now or wait. In order to help them with their decision, we ran MLS data for Ladue (their municipality of choice) for homes ranging in size from 3000-5500 square feet with at least 4 bedrooms and at least 3 bathrooms. The chart below shows the high, median and average sale prices along with the average days on market as well as the list to sale price ratios for homes matching that criteria.

Sales Data Between 2007-2018

In 2007 the median home sale price was $890,942. By 2010, the median sale price fell to $765,000. During the spring of 2018, the median price was up to $945,000. It is clear that the home values were much lower in 2010 and have been rising along with the recovery. And the question is, should they buy now or wait?

Some are Wondering if They Should Buy Now or Wait For The Recession?

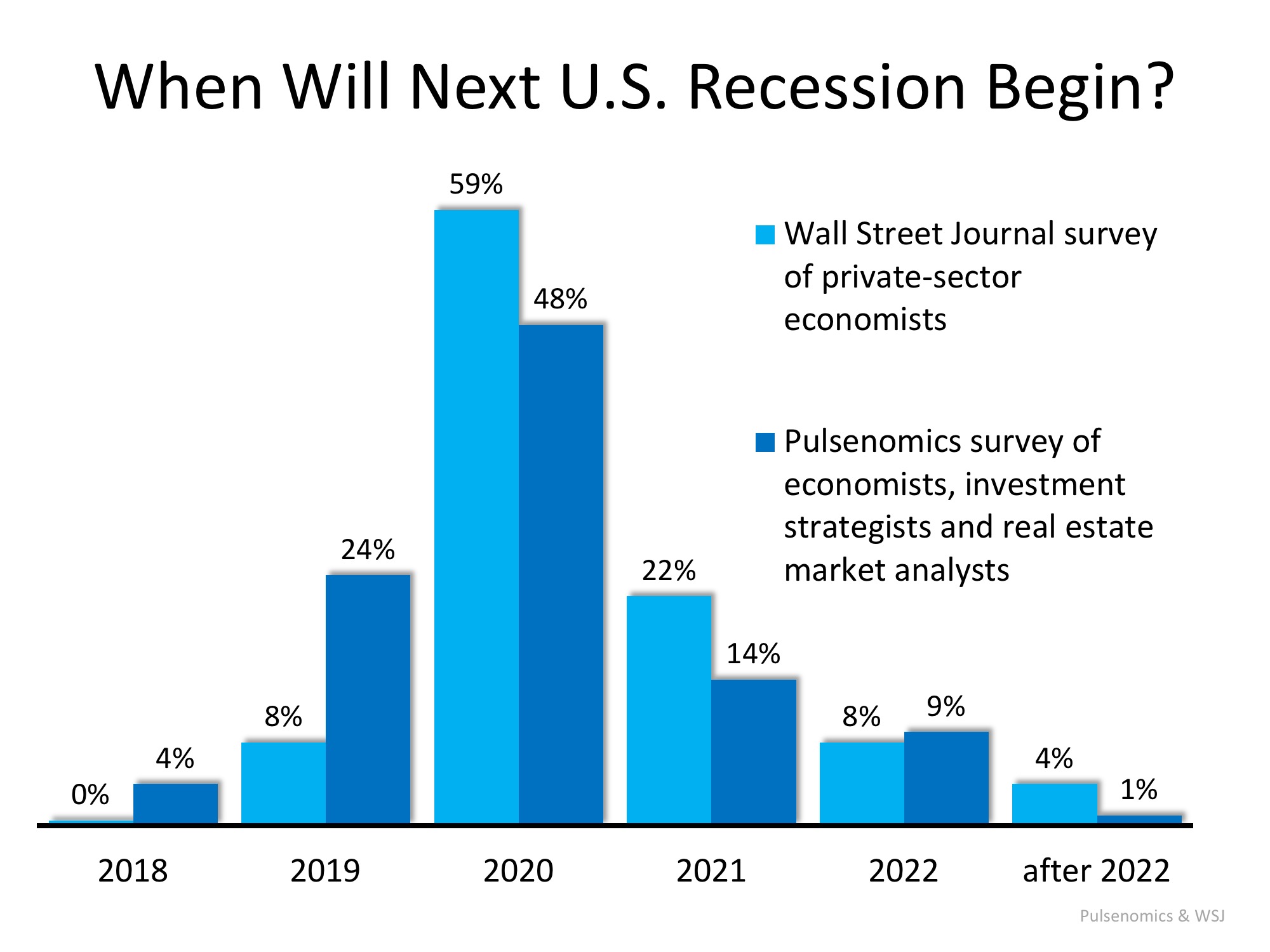

The economy has been growing for over a decade, many economists and analysts are forecasting a potential recession. A recent report by Zillow Research highlighted a survey conducted by Pulsenomics in which they asked economists, investment strategists and market analysts how they felt about the current housing market. That report revealed the possible timing of the next recession:

Experts largely expect the next recession to begin in 2020.

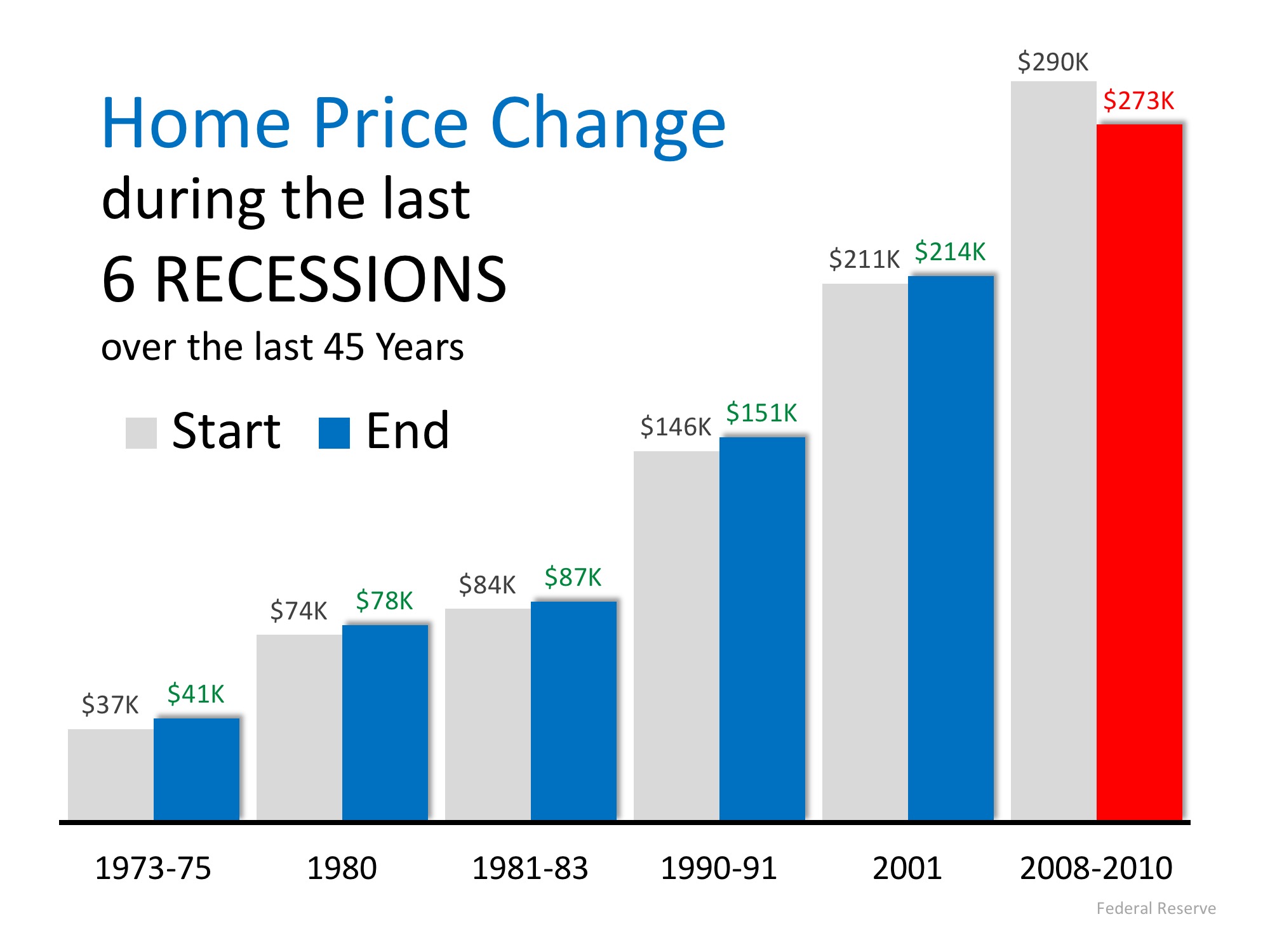

The great recession of 2008 was caused by a flood of foreclosures and as those foreclosures made their way back to the open market, they pushed housing values down.

A recession means the economy has slowed down markedly. It does not mean we are experiencing another housing crisis. Obviously, the housing crash of 2008 caused the last recession. However, during the previous five recessions home values appreciated.

According to the experts surveyed by Pulsenomics, the top three probable triggers for the next recession are:

- Monetary policy

- Trade policy

- A stock market correction

A housing market correction was ranked ninth in probability. Those same experts also projected that home values would continue to appreciate in 2019, 2020, 2021 and 2022.

Cost of Waiting: Renting

If they decided to wait, it’s hard to know how long they would need to rent. If the recession is not projected until 2020 and housing values are projected to appreciate through 2022 that means they might need to rent for 4 years before they see values level out or decrease. A 4 bedroom/ 3 bathroom home in Ladue rents for $5,000/month which means that after 12 months, the family would have spent $60,000 on rent. At 18 months, $90,000 and at 2 years, $120,000 in rental expenses. Compare that cost to the cost of purchasing.

Purchase Price and Interest Rate Variables

Next up for consideration is purchase price and interest rates. For this, I reached out to Mark Anderson a local lender with Carrollton Bank. Two scenarios are detailed below.

There is risk either way. Buying now, means they risk possible depreciation. While waiting means they spend a considerable amount on rent without any noticeable savings on the purchase price.

At the crux of the debate is whether or not an impending recession will affect housing prices and while no one knows for sure many economists agree that housing will not be impacted like it was a decade ago.

Mark Fleming, First American’s Chief Economist, explained:

If a recession is to occur, it is unlikely to be caused by housing-related activity, and therefore the housing sector should be one of the leading sources to come out of the recession.

And U.S. News and World Report agreed:

Fortunately – and hopefully – the history of recessions and current issues that could harm the economy don’t lead many to believe the housing market crash will repeat itself in an upcoming decline.

Bottom Line

A recession is probably less than two years away. A housing crisis is not. The best way to protect any investment is to hold it for the long term.